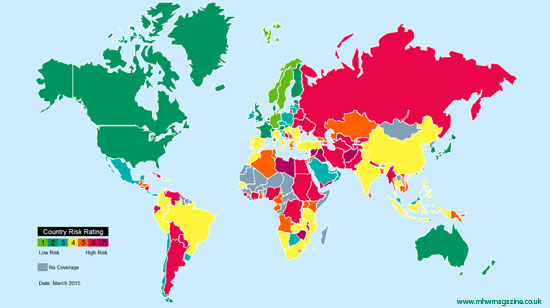

The commodity price crash and a slowdown in China have begun to shift the global map of supply chain risk away from manufacturers in advanced economies, back towards the suppliers and producers at the foot of the global economy, according to the Chartered Institute of Procurement and Supply’s (CIPS) Risk Index.

In the 12 months since the Index’s first release in Q1 2014, global supply chain risk dropped from 79.8 to 77.9 by the third quarter of 2014. The fall is part of a longer trend of falling supply chain risk since the backdated Index record of 82.4 in the third quarter of 2013. That improvement was partly the result of growing financial stability for vital manufacturers based in the advanced economies of North America and Western Europe as each region has reduced its contribution to global supply chain risk from 6.53 and 25.32 respectively in Q1 2014 to 6.32 and 24.31 in Q1 2015.

Since the last quarter of 2014, however, global supply chain risk has resumed its upward trajectory and is back on course to return to record highs, standing at 78.7 in the first quarter of 2015. CIPS has warned that the Index, which is produced with research specialists Dun & Bradstreet, signals that the sustained drop in commodity prices has bitten hard into the durability of suppliers at the very base of global supply chains whilst the developed world temporarily benefits from lower input costs.

In Latin America, Brazilian, Chilean and Argentinian suppliers are all suffering from lower soy bean and copper prices as supply chain risk reached a record high of 5.85 in Q1 2015, up from just 5.73 in Q3 2014. Brazil, in particular, has cut infrastructure investment over the last two quarters as it looks to improve its credit rating. As the world’s second largest producer of hydroelectric power, Brazil has struggled to maintain a consistent supply of power to businesses during an ongoing drought. The episode has raised concerns about the reliability of an economy which also supplies iron ore, gold, poultry and sugar cane to China, the USA and Europe.

Sub-Saharan Africa is also contributing a record level of risk to global supply chains. Government revenues have collapsed as a result of falling oil and gas prices with Nigeria, Angola and Ghana hit particularly badly. As finances deteriorate further into 2016, transport investment throughout the region is expected to slow, undermining the reliability of gold, rubber and cocoa supply chains as well as petroleum, seeing the region’s contribution to global supply chain risk jump to 2.44 in Q1 2015 from 2.38 at the same time last year.

The same forces are at work in parts of the Middle East. Bahrain, whilst more diversified than economies like Nigeria, still relies on commodities for 80% of its revenue and the resulting economic slump has helped to fuel political unrest. The Ebola virus, meanwhile, has not left a lasting economic impact on African supply chains with only a handful of mines in Sierra Leone being disrupted by quarantines and travel restrictions. Australia, meanwhile, is experiencing the highest unemployment for 13 years as iron ore prices worsen and investment continues to fall.

Western Europe and North America have been the main beneficiaries of the movement of risk down the supply chain with their risk scores both improving by one point over the course of the year. Despite decreasing levels of certainty further down the supply chain, centres of advanced manufacturing have enjoyed lower input prices as a result of the fall in commodities.

Despite the slight reduction in risk on a global level, CIPS has warned that widespread uncertainty about where the next crisis could hit has left supply chain managers struggling to mitigate risk or develop robust contingency plans for the year ahead. This uncertainty is threatening to paralyse businesses as they attempt to plot their way through a medley of potential supply chain disruptions.

In Asia Pacific, the vital Chinese manufacturing and heavy industrial sectors are at risk of defaulting on state backed loans, whilst there has already been a shift in manufacturing to the cheaper labour of neighbouring Indonesia.

Japanese growth remained stable this quarter, but deflation is also a risk in Europe, where the UK’s inflation rate has been stuck at zero for two consecutive months and suppliers could face a prolonged period of cost cutting. A US interest rate hike is also being watched for by procurement teams as the already appreciating currency threatens to make American exports unaffordable. Finally, the long term impact of the rise of IS in Syria and Iraq remains uncertain. Should Islamic State’s fighters begin to return home across MENA this year, supply chain managers could find governments becoming less stable and supply chains less reliable.

John Glen, CIPS Economist and Senior Economics Lecturer at The Cranfield School of Management said:

“The global economy relies on the ability of supply chain managers to keep products moving around the world regardless of armed conflict, economic crisis or political instability.

“Businesses are faced with the prospect of political turmoil in Europe and economic slowdown in China but with no safe havens left for supply chains, businesses simply do not know where to turn.

“With no simple solution, supply chain managers must be the eyes and ears of their business wherever their supply chains lead. Only by developing personal relationships and acquiring an intimate understanding of their suppliers, will supply chain managers navigate through this uncertain period.”

Andrew Williamson, Global Leader and Leading Economist, Dun & Bradstreet:

“The CIPS Risk Index is on a deteriorating trend, after successive quarters of rising global risk. The continued sluggish and uneven pace of the global economic recovery is edging our risk score uncomfortably close to its historical high recorded in Q3 2013.

“Most of the deteriorating operational risk environment globally originates in less robust than hoped for economic activity in the US in Q1, a revival of jitters in the Euro-Zone and elevated geopolitical risk almost everywhere, just as several major emerging markets continue to splutter and lose traction growth-wise.”