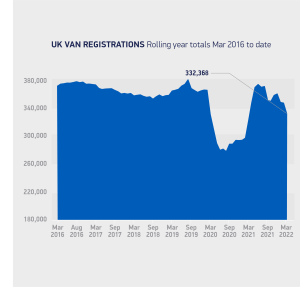

The UK light commercial vehicle (LCV) market declined in March by -27.6% to 40,613 units according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT). The scale of the fall is amplified by comparison with March last year, when pent-up demand contributed to the largest increase in LCV registrations since 1999.1

March is conventionally a bumper period due to the introduction of the new bi-annual number plate, with more LCVs registered last month than January and February combined. However, supply and delivery issues continue to hamper the sector, including the global shortage of semiconductors and those affecting construction, logistics and shipping, with the March market -38.6% down on pre-pandemic 2019.2 Meanwhile, the cyclical process of LCV fleet renewal has contributed naturally to a slower first quarter this year, following a period of robust post-pandemic recovery in 2021.

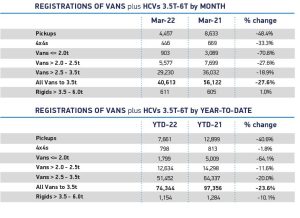

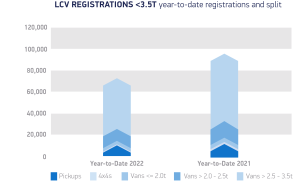

Newly registered large vans, which represent more than two thirds of the LCV market, totalled 29,230 units, -18.9% on March last year, while medium-sized vehicles weighing greater than 2.0 tonnes to 2.5 tonnes declined by -27.6%. Small vans, meanwhile, decreased by -70.8% and pickups by -48.4%. Recent high year-on-year demand for 4x4s also slowed, decreasing by -33.3%.

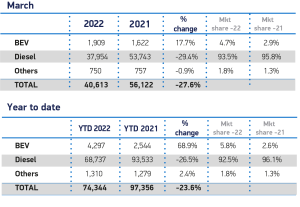

Battery electric vans (BEV) continue to attract interest as businesses renewing their fleets look to meet tighter air quality regulations in urban areas, with registrations rising by 17.7% year-on-year to 1,909 units. Compared with Q1 last year, electric van uptake increased by 68.9% to a market share of 5.8%, more than double a year ago but still some distance behind fully electric passenger cars.3 Further investment is needed in the right types of chargepoint infrastructure in all regions of the UK so that more fleet and self-employed van operators can be confident to make the switch.

At the end of the first quarter this year, LCV registrations are down by -23.6% after three months of consecutive decline compared with a strong start in 2021, when the construction and home delivery sectors were significant drivers of demand, while Q1 in 2022 represents a 27.6% fall on pre-pandemic 2019.4

Mike Hawes, SMMT Chief Executive, said, “The light commercial vehicle market has made a slower start to 2022 compared with the first quarter of last year, reflecting the cyclical nature of fleet operator investment, amid global supply shortages and increasing economic pressures. Targeted support from government is needed to encourage fleet renewal and a full zero emission van market. The expansion of the Plug-in Van Grant will be a positive for the sector, but equally there needs to be a greater roll-out of suitable chargepoints to ensure fleet and self-employed van operators in all regions can make the transition.”

The Society of Motor Manufacturers and Traders (SMMT) is one of the largest and most influential trade associations in the UK. It supports the interests of the UK automotive industry at home and abroad, promoting the industry to government, stakeholders and the media.

The automotive industry is a vital part of the UK economy, and integral to supporting the delivery of the agendas for levelling up, net zero, advancing global Britain, and the plan for growth. It contributes £60 billion turnover and £12 billion value added to the UK economy, and invests around £3 billion each year in R&D. With more than 155,000 people employed directly in manufacturing and some 800,000 across the wider automotive industry, it accounts for 11% of total UK exports with more than 150 countries importing UK produced vehicles, generating more than £73 billion of trade.

More than 30 manufacturers build more than 70 models of vehicle in the UK, supported by more than 2,500 component providers and some of the world's most skilled engineers. The automotive sector also supports jobs in other key sectors – including advertising, chemicals, finance, logistics and steel. Many of these jobs are outside London and the South-East, with wages that are around 25% higher than the UK average.

More detail on UK automotive available in SMMT's Motor Industry Facts 2021 publication at smmt.co.uk/facts21